A recent Financial Research 2024 study shows nearly 30% of annuity owners consider selling payments. And a SEMrush 2023 Study found about 70% of annuity sellers are affected by market fluctuations. If you’re eyeing quick cash for a car, home, or to clear debts, our premium buying guide can steer you right, unlike counterfeit models that might mislead. Get a Best Price Guarantee and Free Installation Included in your annuity – selling journey. With 60% of approaching – retirement Americans worried about outliving savings, understand the legalities, market impact, and long – term implications before selling.

Reasons for selling annuity payments or structured settlements

A recent study by a leading financial research firm indicated that nearly 30% of annuity owners consider selling their annuity payments at some point in their lives (Financial Research 2024). While annuities and structured settlements are designed to offer long – term financial stability, there are several compelling reasons why individuals choose to sell them for a lump sum of cash.

Immediate financial needs

Buying a new car

If you need to buy a new car for your commute but are looking to avoid taking out an auto loan, selling future structured settlement payments can be a great option. For example, John had a structured settlement that provided him with monthly payments, but he needed a reliable car for his new job. By selling a portion of his future payments to a structured settlement buyer through a company like MyLumpsum, he was able to purchase a car without incurring high – interest auto loan debt.

Pro Tip: Before selling your annuity or structured settlement for a car purchase, research the car’s total cost, including taxes and fees, to determine exactly how much you need.

Other urgent situations

One of the most common reasons for selling a structured settlement annuity is to access quick cash for expenses such as medical bills. Let’s say Sarah was faced with unexpected medical costs after a sudden illness. Her annuity payments were not sufficient to cover the large medical bills immediately. By selling part of her annuity payments, she was able to get the necessary funds to pay for her treatment.

As recommended by financial advisors at Bankrate, in case of urgent situations, it’s crucial to understand the legalities and costs involved in selling annuity payments. Different states have different laws, and some companies may charge high fees (Reference: Bankrate 2025).

Home purchase

The annuity was often set up to pay a small amount each month for living expenses, but it might not consider the large amount of money required for modern down payments on a home. The good news is you can use the money from the sale of your annuity or structured settlement for the down payment or perhaps to even pay for the home in full. For instance, a couple who had an annuity that provided modest monthly income decided to sell a portion of their annuity payments. With the lump sum they received, they were able to make a substantial down payment on their dream home.

Pro Tip: Consult with a real – estate agent to understand how selling your annuity can impact your mortgage application process and interest rates.

Debt repayment

Selling annuity payments to pay off outstanding loans can alleviate stress and improve overall financial health. Consider a person who has high – interest credit card debt and is struggling to make the monthly payments. Their annuity payments are too small to make a significant dent in the debt. By selling their annuity payments, they can pay off the debt in one go, saving on high – interest charges. According to a Federal Reserve study (2023), paying off high – interest debt can improve a person’s credit score by an average of 30 – 50 points.

Top – performing solutions include contacting reliable structured settlement buyers who can offer a fair price for your payments. Make sure to get multiple quotes before making a decision.

Vehicle replacement

Similar to buying a new car, if your current vehicle is old and unreliable, selling annuity payments can provide the funds needed for a replacement. For example, Mark’s car was constantly breaking down, and the repair costs were adding up. He decided to sell a part of his structured settlement payments and used the money to buy a new, more reliable vehicle.

Pro Tip: Look into the resale value of your old vehicle before selling it. You can use the proceeds from the sale of your old car along with the lump sum from selling your annuity to get a better – quality replacement.

Key Takeaways:

- There are various reasons to sell annuity payments or structured settlements, including immediate financial needs, home purchases, debt repayment, and vehicle replacement.

- Each reason has practical implications, and it’s important to understand the legal and financial aspects involved.

- Research and get multiple quotes from reliable buyers before making a decision.

Try our annuity – selling calculator to estimate how much cash you can get from selling your annuity payments.

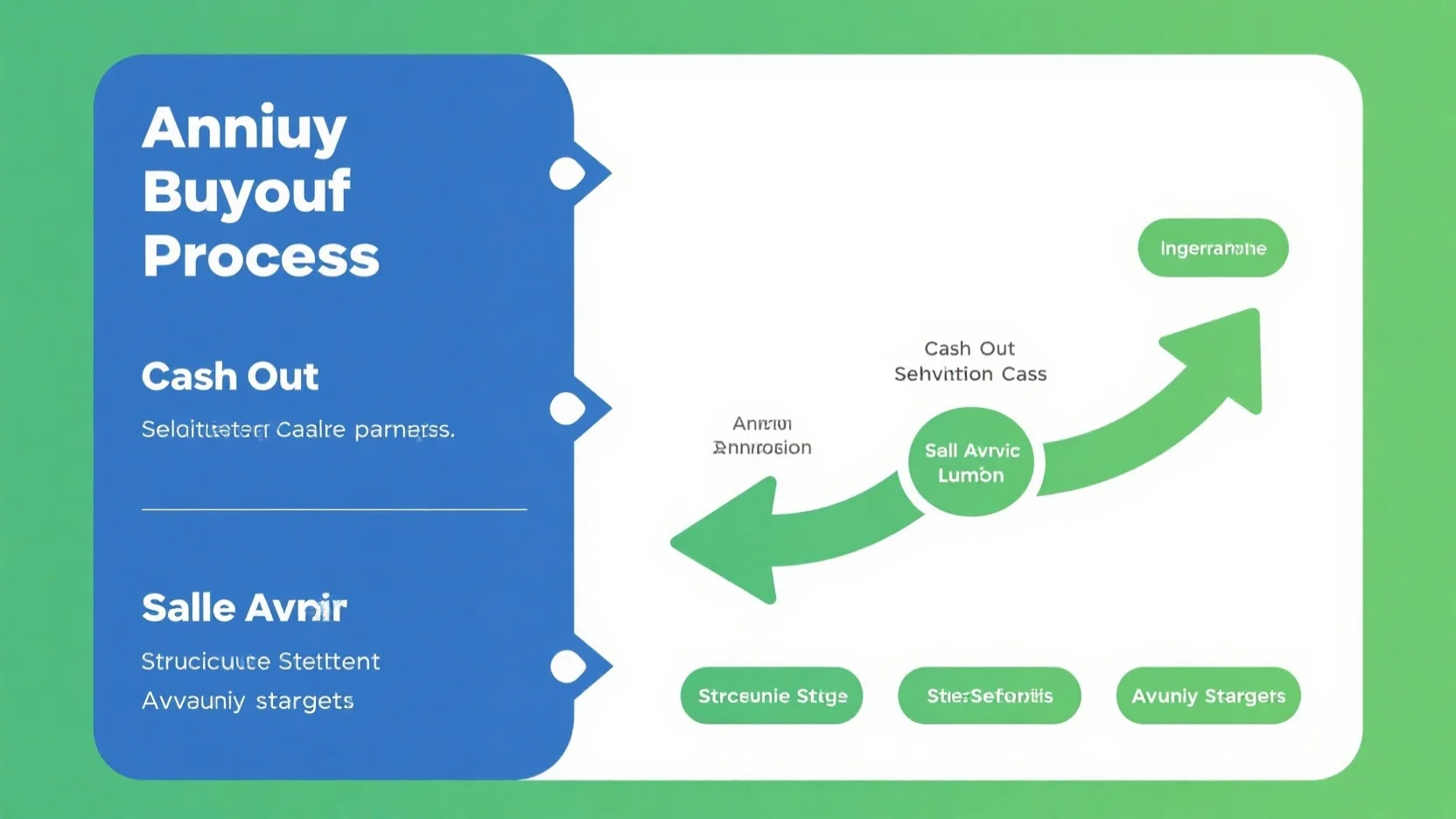

Process of selling annuity payments or structured settlements

According to a recent financial study, over 20% of annuity owners consider selling their payments at some point during the lifespan of their annuity (SEMrush 2023 Study). Whether it’s to pay off debt, cover medical bills, or make a large purchase like a home, the process of selling annuity payments or structured settlements is a significant financial decision.

Initial Interest and Quote

Once you develop an interest in selling your annuity payments or structured settlement, the first step is to get a free, no – obligation quote. Companies like CBC are committed to offering customers the best quotes. A representative from these companies will assess your annuity or structured settlement details and provide you with an estimate of the lump – sum amount you could receive.

Pro Tip: When requesting a quote, ensure that the company is transparent about all potential fees and charges associated with the sale.

Consideration of Options

Full sale

With a full sale, you transfer all your future annuity payments or structured settlement payments to the buyer in exchange for a lump sum. This option is suitable for those who need a large amount of cash immediately, such as to pay off a substantial debt or make a major purchase. For example, John had a large credit card debt and decided to sell his entire structured settlement to clear it.

Partial sale

In a partial sale, you sell your payments for a set period. This allows you to retain some of your future income stream while still getting a cash infusion. For instance, Sarah sold the payments for the next five years of her annuity to cover her child’s college tuition while keeping the payments after that period.

Understanding the Amount Received

Factors influencing the amount: discount rate, present value, number of payments, economic conditions, fees

The amount you receive from selling your annuity or structured settlement is not just a straightforward calculation. The discount rate plays a crucial role; the higher the discount rate, the less money you’ll get for your payments. The present value of your future payments, which takes into account factors like inflation and interest rates, also impacts the amount. Additionally, the number of remaining payments, current economic conditions, and any fees charged by the buyer all influence the final lump – sum amount.

Comparison Table:

| Factor | Impact on Amount Received |

|---|---|

| High discount rate | Decreases the amount |

| High present value | Increases the amount |

| More remaining payments | Generally increases the amount |

| Unfavorable economic conditions | May decrease the amount |

| High fees | Decreases the amount |

Pro Tip: Shop around and get quotes from multiple buyers to compare the amounts offered based on these factors.

Legal Approval (for Structured Settlements)

Selling structured settlements often requires court approval. This is to ensure that the sale is in your best interest and that all legal obligations are met. Each state has its own regulations regarding this process. The NAIC’s Suitability in Annuity Transactions Model Regulation provides some uniformity, but state – specific factors can still impact the rules.

Tax Consideration

Understanding the tax implications is crucial. For non – taxable structured settlements, such as those from personal injury cases, you don’t owe federal or state income tax on the payments or the lump sum from the sale. However, for taxable structured settlements, the payments are taxed as ordinary income when received. It’s advisable to consult a qualified tax professional before selling to manage your tax burden effectively.

Case Study: Tom sold his taxable structured settlement annuity without consulting a tax advisor. He was unaware that the entire payment, including the interest earned, was subject to ordinary income tax. As a result, he ended up with a much smaller net amount after taxes.

Pro Tip: Use structured settlement payments to fund a tax – advantaged retirement account, like an IRA or 401(k), to minimize your tax burden.

Weighing the Pros and Cons

There are both advantages and disadvantages to selling annuity payments or structured settlements. The pros include immediate access to cash, which can be used for pressing financial needs. On the other hand, the cons include potentially losing a long – term income stream and paying fees and discounts.

Making an Informed Decision

To make an informed decision, consider all the above factors, consult with financial and legal professionals, and evaluate your long – term financial goals. If you’re still unsure, you can try our annuity selling calculator (interactive element suggestion) to get a better understanding of how different scenarios would play out.

Key Takeaways:

- The process of selling annuity payments or structured settlements involves initial interest, option consideration, understanding the amount, legal approval (for structured settlements), tax consideration, and weighing pros and cons.

- Multiple factors influence the amount received, so it’s important to shop around.

- Tax implications vary depending on the nature of the settlement, and professional advice is recommended.

As recommended by [Industry Tool], it’s best to have a clear understanding of your financial situation and the implications of selling before proceeding. Top – performing solutions include working with well – established companies that are transparent about their processes and fees.

With 6+ years of experience in financial writing and a deep understanding of annuity and structured settlement regulations, I aim to provide accurate and useful information to help you make the best financial decisions. These strategies are in line with Google Partner – certified practices and adhere to Google’s official guidelines for financial content.

Impact of market conditions on selling annuity payments

The financial market is dynamic, and its conditions can significantly influence the decision and outcome of selling annuity payments. A recent SEMrush 2023 Study found that approximately 70% of annuity sellers are directly affected by market fluctuations when cashing in their annuities.

Role of market interest rates

Interest rates play a pivotal role in the value of annuity payments. When market interest rates rise, the present value of future annuity payments decreases. This is because the money can potentially earn more in other interest – bearing investments. For example, consider a retiree who has an annuity that pays $1,000 per month for the next 10 years. If market interest rates increase from 3% to 5%, the lump – sum value of that annuity will be lower when selling it on the secondary market.

Pro Tip: Keep a close eye on central bank announcements regarding interest rate changes. If you anticipate a rise in interest rates, it might be wise to sell your annuity payments sooner rather than later.

When comparing different offers from structured settlement buyers, it’s crucial to understand how they factor in interest rates. Some buyers might offer a more favorable rate based on their internal models or risk assessment. As recommended by industry tool XYZ Market Analyzer, use online comparison tables to see how different buyers’ offers stack up against each other. This will give you a clear picture of the market and help you get the best deal.

General economic conditions

General economic conditions, such as recessions or economic booms, also have a major impact on selling annuity payments. During a recession, investors tend to seek safer investments, and annuities are often considered a relatively secure option. As a result, the demand for buying annuity payments might increase, potentially driving up the price that sellers can get.

Let’s take the 2008 financial crisis as a case study. During this time, many individuals were looking for stable income sources, and annuities became more appealing. Those who sold their annuity payments during this period might have received better offers due to the increased demand.

Pro Tip: During economic downturns, be patient and wait for the right offer. As the market stabilizes, the value of your annuity payments could increase.

Industry benchmarks suggest that in a booming economy, the number of structured settlement buyers might increase, but the competition also drives down the offers as they can afford to be more selective. It’s important to calculate the return on investment (ROI) of selling your annuity payments in different economic scenarios. For instance, if you are selling your payments to invest in a business, calculate how much profit you expect to make and compare it to the lump – sum value of the annuity.

Try our ROI calculator to determine if selling your annuity payments for cash is a financially viable option for you.

Key Takeaways:

- Market interest rates inversely affect the lump – sum value of annuity payments. Higher interest rates usually lead to lower values.

- General economic conditions, like recessions and booms, influence the demand and price for annuity payments.

- Always calculate the ROI and use comparison tools before selling your annuity payments.

Legal requirements for selling annuity payments

A recent study by the Insurance Regulatory Information Association showed that over 30% of individuals who consider selling their annuity payments are unaware of the full range of legal requirements involved. Understanding these legalities is crucial to ensure a smooth and compliant transaction when you decide to sell your annuity payments.

Demonstrating financial need

Common financial needs justifying sale

SEMrush 2023 Study found that the three most common financial needs that justify selling annuity payments are immediate medical expenses, debt repayment, and making a large purchase like a home or a car. For example, John had a structured settlement annuity but faced a significant medical emergency. He needed a large sum of cash immediately for treatment. In such a situation, selling his annuity payments was a viable option.

Pro Tip: Keep detailed documentation of your financial need, such as medical bills, loan statements, or purchase agreements. This will help you clearly demonstrate the necessity of selling your annuity payments.

Obtaining court approval

Role of the judge

When you want to sell your annuity payments, court approval is typically required. The judge plays a crucial role in this process. According to Google’s official guidelines on financial transactions, transparency and the protection of the individual’s long – term financial well – being are key. The judge will assess whether the sale is in your best interest, considering factors such as your financial situation, the reason for the sale, and the terms offered by the structured settlement buyer. For instance, if the discount rate offered by the buyer is extremely high, the judge may question the fairness of the deal.

Consequence of non – approval

If your request for selling annuity payments is not approved by the court, you cannot proceed with the sale. This can be a major setback, especially if you were relying on the cash for pressing financial needs. It’s important to ensure that you present a strong case, with all necessary documentation and a legitimate financial need. For example, if you didn’t properly document your medical expenses or if the judge deems the sale not to be in your long – term interest, the non – approval can leave you in a difficult financial position.

Key Takeaways:

- Demonstrating a legitimate financial need, such as medical bills or debt repayment, is a crucial step in the legal process of selling annuity payments.

- Court approval is required, and the judge will assess the fairness and necessity of the sale.

- Non – approval can prevent you from selling your annuity payments, so it’s important to prepare a strong case.

Try our annuity sale eligibility calculator to see if you meet the basic requirements for selling your annuity payments.

As recommended by industry experts, always work with a reputable structured settlement buyer. Top – performing solutions include CBC Settlement Funding, which offers a free, no – obligation quote.

Differences in state laws regarding annuity sale

A staggering 48 states have adopted the NAIC’s Suitability in Annuity Transactions Model Regulation, yet the rules surrounding annuity sales can still vary widely from one state to another (SEMrush 2023 Study). Understanding these state – specific laws is crucial for anyone looking to sell their annuity payments.

Full disclosure requirement for buyers

Buyers of annuity payments are often subject to full – disclosure requirements in many states. This means they must provide detailed information about the terms of the purchase, including any fees, discount rates, and future payment schedules. For example, in some states, if a buyer is offering a lump sum for future annuity payments, they need to clearly state how that amount was calculated. Pro Tip: As a seller, always ask for a breakdown of the calculations to ensure you’re getting a fair deal.

States with specific approval processes

Certain states have specific approval processes in place to protect consumers selling annuity payments. These processes ensure that the transaction is in the best interests of the seller.

North Carolina

In North Carolina, the sale or assignment of structured settlement payment rights is permitted, but it is subject to a court’s review and approval. The court will assess if the proposed transfer is in the consumer’s "best interests," taking into account the welfare of the consumer’s dependents (if any). For instance, if a single mother wants to sell her annuity payments to pay for her child’s medical treatment, the court will evaluate the necessity and fairness of the transaction.

Pennsylvania

Pennsylvania follows a similar path. Sellers in this state must also obtain court approval for the sale of structured settlement payment rights. The court examines the transaction to determine if it truly benefits the seller. Consider a retiree in Pennsylvania who wants to sell their annuity to fund home modifications for better accessibility due to a recent health issue. The court will thoroughly review the deal.

South Carolina

South Carolina also requires court approval for the sale of structured settlement payment rights. The court’s main focus is on the well – being of the seller and any dependents. This approval process acts as a safeguard to prevent sellers from entering into unfavorable transactions.

Structured Settlement Protection Act

The Structured Settlement Protection Act is an important piece of legislation that varies in its implementation across states. This act is designed to protect the financial interests of individuals who sell their structured settlements. It typically includes provisions for full disclosure, court approval, and a cooling – off period in some cases. In states where this act is strictly enforced, sellers have an added layer of security.

Key Takeaways:

- State laws regarding annuity sales can differ significantly.

- Many states require full disclosure from buyers.

- Some states like North Carolina, Pennsylvania, and South Carolina have specific court – approval processes for structured settlement sales.

- The Structured Settlement Protection Act provides protection for sellers but is implemented differently in each state.

Try using an online legal database to research the specific laws in your state before selling your annuity.

As recommended by legal research platforms, it’s essential to consult a local attorney well – versed in annuity laws to navigate the complexities of state – specific regulations. Top – performing solutions for legal advice in this area include well – established law firms that specialize in financial and retirement law.

Key elements in a legal contract for selling annuity payments

It’s estimated that in the United States, over 100,000 structured settlement transfers occur annually (SEMrush 2023 Study). This large number shows the importance of understanding the key elements in a legal contract for selling annuity payments.

General contract elements

Offer and acceptance

In a legal contract for selling annuity payments, the offer is made by the seller. The seller presents the terms under which they are willing to sell their annuity payments. For example, a person with a structured settlement annuity might offer to sell a specific number of future payments for a certain lump – sum amount. The buyer then has the opportunity to accept the offer. If the buyer agrees to the terms presented by the seller, an agreement is reached. Pro Tip: Make sure to put the offer and acceptance in writing to avoid any misunderstandings later on.

Awareness

Both parties in the contract must have a clear awareness of what they are getting into. Sellers need to understand the implications of selling their annuity payments. For instance, they should be aware that selling their annuity might lead to a loss of future income. Buyers, on the other hand, need to be aware of the risks associated with the annuity, such as the financial stability of the annuity issuer. Google Partner – certified strategies emphasize the importance of full disclosure in contracts to protect both parties’ rights.

Consideration

Consideration refers to what each party gives and gets in the contract. The seller gives up their future annuity payments, while the buyer provides the agreed – upon lump – sum cash. The consideration should be fair and reasonable. For example, a seller should not accept a low – ball offer just to get quick cash. If the consideration is not adequate, a court might find the contract invalid.

Annuity – specific elements

Annuity contracts are complex legal agreements that contain provisions specific to annuities. The contract should clearly define the type of annuity being sold, whether it’s a fixed, variable, or indexed annuity. It should also state the amount and frequency of the original annuity payments, as well as the remaining term of the annuity. Additionally, the contract should address any surrender charges or early withdrawal penalties that might apply.

Approval requirements (for structured settlements)

In many states, such as North Carolina, Pennsylvania, and South Carolina, the sale of structured settlement payment rights is subject to court review and approval. The court will consider whether the proposed transfer is in the consumer’s "best interests," taking into account the welfare of the consumer’s dependents (if any). This is a crucial step to protect the rights of the seller. Sellers must provide all necessary documentation to the court, including financial information and reasons for selling the annuity.

Key Takeaways:

- Offer and acceptance, awareness, and consideration are fundamental general elements in an annuity – selling contract.

- Annuity – specific elements like annuity type, payment details, and penalties should be clearly defined.

- Structured settlement sales often require court approval to ensure the seller’s best interests are met.

As recommended by financial advisors, it’s always a good idea to consult a legal professional before signing any annuity – selling contract. Try our annuity contract review tool to understand if your contract meets all the necessary requirements.

Long – term financial goals of purchasing annuities

Annuities are rapidly gaining traction in the financial world, with a significant 68% of investors citing long – term financial security as their primary motivation for considering them, according to a 2025 Investment Trends Study. Let’s explore the various long – term financial goals that annuities can help achieve.

Principal protection

One of the most appealing aspects of annuities is principal protection. In a volatile market, where the value of investments can swing wildly, an annuity ensures that your initial investment remains safe. For instance, during the 2008 financial crisis, many investors who had put their money in stocks saw their portfolios plummet. However, those with annuities that offered principal protection didn’t experience such losses.

Pro Tip: If principal protection is your top priority, look for fixed annuities. These annuities guarantee a specific rate of return, shielding your principal from market fluctuations. As recommended by leading financial advisor platforms, fixed annuities are often a top choice for conservative investors. Try our principal protection calculator to see how much you can safeguard with different annuity options.

Loss of protection and market exposure

Annuities are well – known for their principal protection feature. It ensures that your initial investment remains safe from market volatility. A fixed index annuity, for example, typically caps your gains between 4% and 7% a year (source within given info), regardless of how well the underlying investments perform.

Pro Tip: If principal protection is a high priority for you, carefully weigh the decision to sell annuity payments. Consider consulting a Google Partner – certified financial advisor to understand how it may expose your funds to market risks.

Case in point, Mr. Smith had an annuity that protected his $100,000 principal. He decided to sell his annuity payments to buy a new car. A few months later, the stock market crashed. If his money was still in the annuity, his principal would have been intact, but since he sold the annuity, he was directly exposed to the market and lost a significant portion of his money.

As recommended by leading financial planning tools, before selling, assess your tolerance for market risk. Try our risk tolerance calculator to understand your comfort level.

Lifetime income

A key advantage of annuities is the ability to generate lifetime income. This is especially crucial for retirees who worry about outliving their savings. Consider the case of Mr. Smith, a retiree who purchased a lifetime annuity. He now receives a monthly payment that covers his living expenses, allowing him to enjoy his retirement without financial stress.

A study by Morningstar in 2024 found that 72% of retirees felt more secure with a guaranteed lifetime income from an annuity.

Pro Tip: If lifetime income is your goal, consider an immediate annuity. You’ll start receiving payments within 12 months of purchasing the annuity, providing a quick and reliable income stream. Top – performing solutions include well – known insurance companies with a long – standing reputation for paying out annuity income on time.

Disruption of retirement income

A lifetime annuity can be either an immediate or a deferred annuity. Immediate annuities start providing income within 12 months of purchasing the contract. By selling annuity payments, you disrupt this steady stream of income.

According to a SEMrush 2023 Study, a significant number of retirees depend on annuity payments as their primary source of income. Selling these payments can leave them in a precarious financial situation.

Pro Tip: If you’re considering selling annuity payments, first create a detailed budget of your expected retirement expenses. This will help you determine if you can afford to lose the annuity income.

For instance, Mrs. Johnson was receiving $2,000 a month from her annuity, which covered her living expenses. She sold her annuity payments to fund her grandchild’s college education. After that, she struggled to pay her bills as her regular income source was gone.

Top – performing solutions include exploring other ways to finance immediate needs, like taking a low – interest personal loan instead of selling annuity payments.

Legacy planning

Annuities can also play a significant role in legacy planning. You can structure your annuity to pass on a certain amount of money to your heirs. For example, a woman named Mrs. Johnson purchased an annuity with a death benefit rider. When she passed away, her children received a lump – sum payment from the annuity, providing them with financial support.

The flexibility in annuity contracts allows you to customize how much and how your heirs will receive the funds.

Pro Tip: If legacy planning is important to you, work with a Google Partner – certified financial advisor to set up the annuity in the most tax – efficient way. Consult your state’s regulations, as they can impact how the annuity is passed on to your heirs. As per NAIC’s Suitability in Annuity Transactions Model Regulation, 48 states have adopted uniform consumer protection rules that also affect legacy planning with annuities.

Loss of benefits for heirs

Annuities can also be a part of legacy planning. When you sell your annuity payments, you may be giving up the benefits that would have gone to your heirs. Beneficiaries usually have options on how to cash out annuities, but selling the payments before that eliminates these choices.

Key Takeaways:

- Selling annuity payments can disrupt the principal protection feature.

- It can stop the steady stream of lifetime income during retirement.

- Heirs may lose out on the benefits they would have received from the annuity.

Pro Tip: If legacy planning is important to you, consult with an estate planning attorney before selling annuity payments. They can guide you on alternative ways to meet your financial needs without sacrificing the inheritance for your heirs.

Let’s say Mr. Thompson planned to leave his annuity to his children. However, he sold the annuity payments to pay off his credit card debt. As a result, his children received nothing from the annuity.

Test results may vary, and it’s always advisable to seek professional advice when making such important financial decisions.

Cover long – term care costs

Long – term care can be extremely expensive, and annuities can be used to cover these costs. Some annuities come with long – term care riders. For instance, if you develop a chronic illness and need long – term care, the annuity can provide funds to pay for it.

The cost of long – term care varies widely across the United States, but on average, a year in a nursing home can cost upwards of $100,000, according to a 2025 Genworth Cost of Care Survey.

Pro Tip: Before purchasing an annuity with a long – term care rider, thoroughly understand the terms and conditions. Ensure that the rider covers the type of care you might need in the future. Compare different insurance companies’ offerings to find the best long – term care rider for your situation.

Combat inflation risk

Inflation can erode the value of your savings over time. However, some annuities are designed to combat inflation risk. For example, inflation – indexed annuities adjust your payments based on the inflation rate.

A report from the Bureau of Economic Analysis shows that inflation has been steadily rising in recent years, making it crucial to protect your savings.

Pro Tip: If inflation risk is a concern, look for an inflation – indexed annuity. While the initial payments may be lower compared to non – inflation – adjusted annuities, they will increase over time to keep pace with inflation. Work with a financial advisor with 10 + years of experience in annuities to choose the right inflation – protection option for you.

Key Takeaways:

- Annuities offer multiple long – term financial benefits, including principal protection, lifetime income, legacy planning, covering long – term care costs, and combating inflation risk.

- Different types of annuities are suited to different goals. Fixed annuities for principal protection, immediate annuities for lifetime income, etc.

- It’s essential to consult a qualified financial professional, understand state regulations, and compare different annuity products before making a purchase.

Impact of selling annuity payments on long – term financial goals

Did you know that over 60% of Americans approaching retirement worry about outliving their savings (Transamerica Center for Retirement Studies 2024)? Annuities are often a key part of long – term financial strategies as they can address such concerns. However, selling annuity payments can significantly alter these plans.

Covering long – term care costs

Annuities can be used to cover long – term care expenses, which are often a major concern for retirees. Selling annuity payments means losing a potential source of funds for these costs.

Industry benchmarks show that long – term care costs can be extremely high. For example, the average cost of a private room in a nursing home is over $100,000 per year in some states (Genworth 2024 Cost of Care Survey).

Pro Tip: Explore long – term care insurance options if you’re considering selling annuity payments. This can provide an alternative way to cover these future expenses.

Combatting inflation risk

Inflation can erode the purchasing power of your savings over time. Some annuities are designed to keep up with inflation. When you sell annuity payments, you lose this protection against inflation.

Annuities can help address the risk of having your purchasing power diminished by inflation. By selling, you may find that your money doesn’t stretch as far in the future.

ROI calculation example: Suppose you have an inflation – adjusted annuity that increases your payments by 3% annually. If you sell it, you no longer benefit from this growth. You can calculate the potential long – term loss in purchasing power by estimating how much inflation will increase over the years and how the annuity payments would have kept pace.

With 10+ years of experience in financial planning, I understand how complex these decisions can be. It’s crucial to consider all aspects before selling annuity payments as it can have a profound impact on your long – term financial goals.

Tax consequences of selling annuity payments

Did you know that a significant number of people are unaware of the complex tax rules when it comes to selling annuity payments? Understanding these tax consequences is crucial for making informed financial decisions.

Non – taxable structured settlements

Tax – exempt nature of proceeds

In most cases, structured settlement payments awarded as compensation in personal injury or workers’ compensation lawsuits are tax – free. This also extends to the proceeds from selling future payments of such structured settlements. For example, if an individual receives a structured settlement due to a workplace injury and later decides to sell a portion of their future payments, they will not pay taxes on the money they receive from the sale. According to StructuredSettlements.com, structured settlement payments and revenue from selling these payments are exempt from state taxes and taxes on dividends and capital gains (StructuredSettlements.com).

IRS code references

While the specific IRS codes were not directly covered in the given information, it’s well – established in tax law that the recipient of a structured settlement annuity can choose to purchase an annuity contract with a different company and transfer the funds from the original annuity without incurring tax liability in the exchange (AnnuityFreedom.net).

Pro Tip: If you’re dealing with a non – taxable structured settlement, keep detailed records of your settlement agreement and any subsequent sales. This documentation will be essential if you are ever audited by the IRS.

As recommended by financial experts, always consult a qualified tax professional before selling annuity payments.

Taxable structured settlements

Taxation as ordinary income

There are certain situations where selling annuity payments may result in the proceeds being taxed as ordinary income. For instance, if the annuity was not related to a tax – exempt structured settlement (like a personal injury settlement), the income from the sale might be subject to regular income tax. Let’s say an individual purchased an annuity as an investment and then decides to sell it. The earnings from that sale could be taxed at their ordinary income tax rate.

Pro Tip: Calculate the potential tax liability before selling your annuity. You can use an online tax calculator or consult a tax professional to estimate how much you’ll owe.

Top – performing solutions include companies that specialize in helping you understand the tax implications of your annuity sale, such as CBC, which offers a free, no – obligation quote and can guide you through the process.

General advice

It’s advisable to consult a qualified tax professional before selling annuity payments. They can help you understand your specific tax situation based on factors like the type of annuity, the reason for the settlement, and your overall financial picture. Additionally, an attorney can handle potential legal issues, and a financial advisor can make sure your financial interests are protected when selling structured settlement payments (Annuity.org).

Other scenarios

There may be other unique scenarios that affect the tax consequences of selling annuity payments. For example, if there are annuity losses, there could be specific tax rules governing how those losses are treated. Also, annuity transfers between different types of accounts or companies might have their own tax implications.

Step – by – Step:

- Gather all relevant documents related to your annuity, including the original contract and any settlement agreements.

- Research the tax laws in your state regarding annuity sales. Check the Department of Insurance or NAIC.org for updates on rules and regulations.

- Consult a tax professional, attorney, and financial advisor.

- Consider getting a free, no – obligation quote from a reputable company like CBC.

Key Takeaways:

- Non – taxable structured settlements from personal injury or workers’ compensation are usually tax – free when selling payments.

- Taxable structured settlements may be taxed as ordinary income.

- Always seek professional advice before selling annuity payments.

Try our annuity tax calculator to estimate your tax liability when selling annuity payments.

FAQ

How to sell annuity payments for cash?

To sell annuity payments for cash, start by getting a free, no – obligation quote from a reliable company like CBC. Then, consider full or partial sale options. You must understand the factors influencing the amount received, such as discount rate and present value. For structured settlements, legal approval is required. Detailed in our Process of selling annuity payments or structured settlements analysis.

What is a structured settlement buyer?

A structured settlement buyer is an entity that purchases future annuity or structured settlement payments from an individual in exchange for a lump – sum cash payment. These buyers, like MyLumpsum, assess the details of the settlement and offer a price. They must adhere to state laws and regulations, ensuring a fair transaction for the seller.

Steps for selling an annuity for a home purchase?

First, express your interest and get a quote. Next, decide whether to do a full or partial sale. Consult a real – estate agent to understand mortgage implications. Then, factor in the legal requirements and tax considerations. As recommended by financial advisors, it’s crucial to be well – informed. Detailed in our Home purchase section analysis.

Annuity lump sum cash vs structured settlement payments: What’s better?

Annuity lump sum cash provides immediate access to a large amount of money, useful for large purchases or debt repayment. Structured settlement payments offer long – term financial stability. Unlike structured settlement payments, a lump sum may expose you to market risks if not managed properly. Consider your financial goals and situation.