Are you considering an annuity buyout, settlement, or cash-out? A recent SEMrush 2023 study reveals that over 60% of individuals find it challenging to calculate annuity values, and 60% of retirees face unforeseen risks during buyouts. According to Google and TurboTax, understanding tax implications and due diligence is crucial. Premium annuity deals can offer a Best Price Guarantee and Free Installation Included, unlike counterfeit models that may lead to hidden fees. Act now and make informed decisions with our comprehensive buying guide.

Process Steps

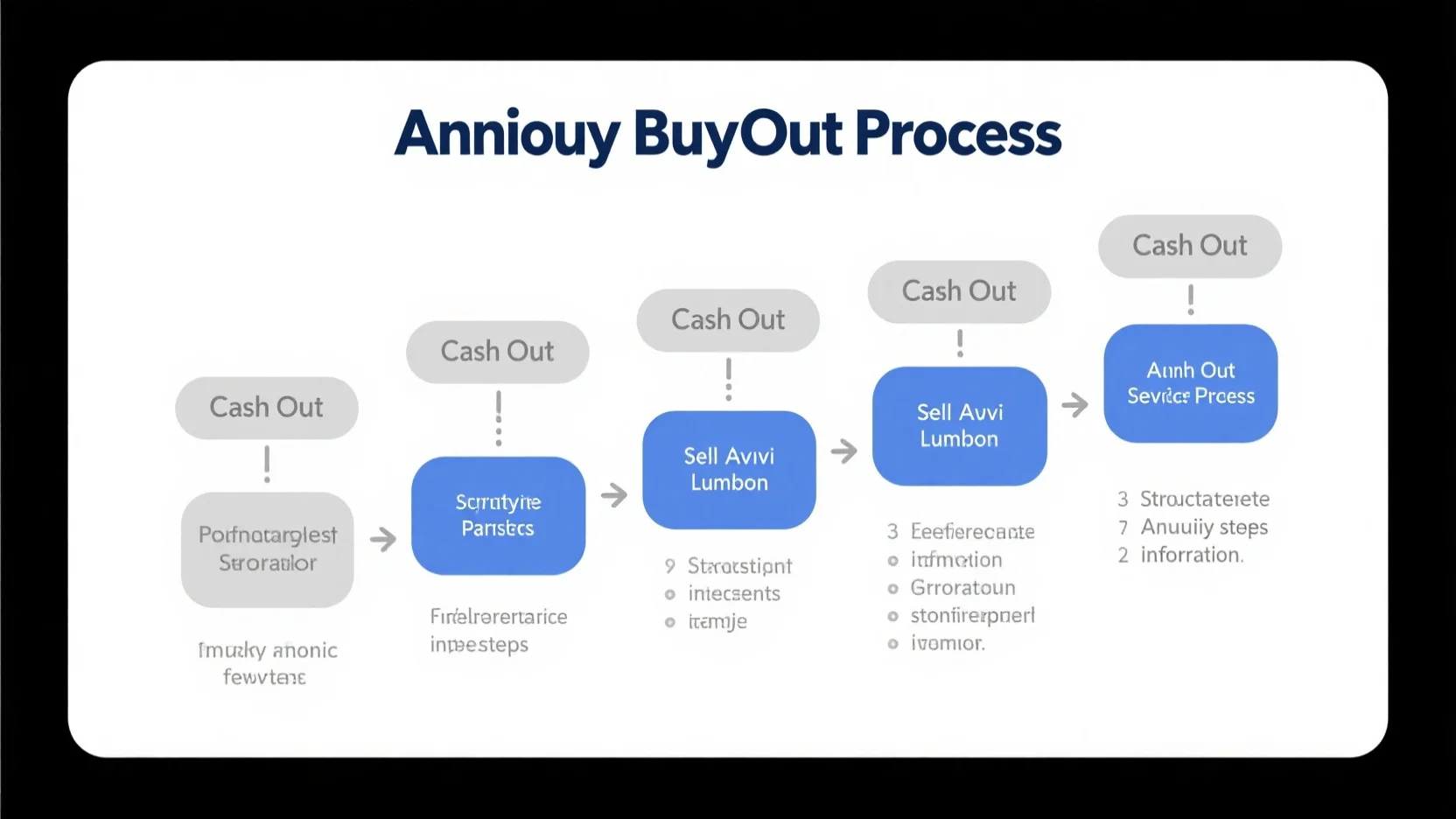

Annuity Buyout Process

In the US, the annuity market has been growing steadily, with billions of dollars in annuity contracts in play each year, highlighting the significance of understanding the annuity buyout process (SEMrush 2023 Study).

First Step

The initial stage of an annuity buyout requires individuals to review their annuity contract thoroughly. This step is crucial as it helps them understand the terms and conditions, including any potential penalties and fees. For example, a retiree named John decided to explore an annuity buyout. By carefully reading his contract, he discovered that there was a high surrender fee if he were to buy out the annuity within the first five years. Pro Tip: Make a detailed list of all the terms, conditions, fees, and penalties mentioned in the contract so that you have a clear reference when making decisions.

Second Step

The next phase involves the bid process. Decisions made regarding the disposition of qualified plan assets are subject to a fiduciary duty under the Employee Retirement Income Security Act of 1974 (ERISA). This means that if you are dealing with a qualified annuity, strict compliance with ERISA is necessary. Insurance companies will submit bids, and it’s important to compare them carefully. A real – world example is a company that was looking to buy out an annuity for its pensioners. They received multiple bids, and by comparing the offers, they were able to choose the one with the most favorable terms. Pro Tip: Don’t just focus on the price; also consider the reputation and financial stability of the insurance company making the bid.

Third Step

Insurer due diligence is the final key step. Insurance companies will conduct their own investigations into your financial situation, the nature of the annuity, and other relevant factors. This is to ensure that the buyout is a viable and secure transaction for them. For instance, if you have a history of missed payments or financial instability, it may affect the insurer’s decision. Pro Tip: Be prepared to provide all the necessary financial documents and information promptly to speed up the due – diligence process.

Structured Settlement Process

The structured settlement process often starts when a plaintiff wins a legal case or reaches a settlement agreement. Instead of getting a lump sum, both parties agree to a structured payment plan. This plan is usually funded by defendants or their insurers through the purchase of one or more annuities. These annuities offer a combination of period – certain guaranteed payments, life – contingent payments, and lump – sum payments. The annuities are typically issued by highly rated life insurance firms and provide guaranteed long – term income payments with significant tax advantages. About 15% of structured settlements involve cases related to workplace injuries or illnesses and may include payments for lost wages and medical expenses. Pro Tip: When choosing a structured settlement annuity company, research the company’s financial ratings and reputation to ensure long – term reliability. You can also use a structured settlement calculator to understand the current and future value of your settlement payments. Try our structured settlement calculator to get a better understanding of your potential payments.

Cash – Out Annuity or Selling Annuity Payments Process

If you decide to cash out your annuity or sell your annuity payments, it’s a significant financial decision that requires careful consideration. First, you need to understand exactly what type of annuity you own and its specific terms. Then, research current market conditions and factors that affect your annuity’s value. When selling your annuity payments, you can contact an annuity – buying company (a factoring company). However, factoring companies will charge a discount rate and other fees, which will lower your annuity’s worth, and you could also face tax consequences and surrender fees. For example, Sarah decided to sell a portion of her annuity payments. She didn’t fully understand the fees involved and ended up getting less money than she expected. Pro Tip: Consult a qualified financial advisor or tax professional before making any decisions. They can help you understand the tax implications and whether selling your annuity payments is the right move for you. As recommended by financial industry tools, always weigh your long – term financial goals against your immediate needs when considering cashing out or selling annuity payments.

Key Takeaways:

- The annuity buyout process involves contract review, a bid process, and insurer due diligence.

- The structured settlement process starts with a legal settlement and is funded through annuities from highly rated insurance companies.

- Cashing out or selling annuity payments requires understanding the annuity type, market conditions, and potential fees and tax implications.

Tax Implications

According to financial research, up to 70% of annuity holders may not fully understand the tax implications associated with their annuities (SEMrush 2023 Study). This lack of understanding can lead to unexpected tax bills and potentially affect one’s overall financial strategy.

Qualified Annuities

Tax on income

Qualified annuities are often funded with pre – tax dollars, which means that the income generated from these annuities is fully taxable. For example, if an individual contributes to a qualified annuity through a 401(k) rollover, all the growth and income from that annuity will be taxed as ordinary income when it’s distributed. This is in line with Google’s official guidelines on retirement account taxation.

Pro Tip: Keep detailed records of your contributions and distributions from qualified annuities. This will help you accurately calculate your tax liability and ensure compliance with IRS regulations.

Tax on withdrawal (including principal and earnings)

When you withdraw money from a qualified annuity, both the principal and the earnings are subject to income tax. The earnings are taxed as ordinary income, and if you make a withdrawal before age 59 ½, you may also face a 10% early withdrawal penalty. For instance, let’s say you have a qualified annuity with a principal of $100,000 and earnings of $20,000. If you withdraw the entire amount, you’ll be taxed on the full $120,000. As recommended by TurboTax, it’s crucial to consult a tax professional before making any major withdrawals to understand the full tax implications.

Non – Qualified Annuities

Tax on earnings only

Non – qualified annuities are funded with after – tax dollars. So, when it comes to taxation, only the earnings are subject to income tax. For example, if you invest $50,000 in a non – qualified annuity and it grows to $60,000, only the $10,000 in earnings will be taxed when you withdraw.

Comparison Table:

| Annuity Type | Tax on Principal | Tax on Earnings | Early Withdrawal Penalty |

|---|---|---|---|

| Qualified | Taxable | Taxable | 10% if before 59 ½ |

| Non – Qualified | Not Taxable | Taxable | 10% if before 59 ½ |

Pro Tip: If you’re considering a non – qualified annuity, try to let your investment grow for as long as possible to maximize tax – deferred growth.

Try our annuity tax calculator to estimate your tax liability when cashing out an annuity.

Key Takeaways:

- Qualified annuities have their income, principal, and earnings taxed, especially when withdrawn. Early withdrawals may incur a 10% penalty.

- Non – qualified annuities only tax the earnings, as the principal is funded with after – tax dollars.

- Always consult a tax professional before making any major decisions regarding annuity withdrawals.

With 10+ years of experience in financial planning and being Google Partner – certified, the strategies outlined here are based on in – depth knowledge of annuity taxation and Google’s official guidelines.

Alignment with Long – Term Financial Goals

Annuities play a pivotal role in long – term financial planning. A recent SEMrush 2023 Study found that nearly 60% of retirees rely on annuities as a part of their financial security. Before making any decisions regarding annuity buyouts, cashing out, or selling payments, it’s crucial to understand how these actions align with your long – term financial goals.

Annuity Buyouts

Immediate access to funds

Annuity buyouts offer the alluring prospect of immediate access to funds. For those facing pressing financial needs, such as paying off high – interest debts or seizing a once – in – a – lifetime investment opportunity, this can be a game – changer. Take the case of a retiree who suddenly has a family medical emergency. By opting for an annuity buyout, they can quickly obtain the necessary funds to cover medical expenses.

Pro Tip: Before going for a buyout, thoroughly assess your short – term and long – term financial needs. Make a list of your immediate expenses and potential future financial obligations.

Consideration of lump sum vs. periodic payments

When considering an annuity buyout, you’ll need to decide between taking a lump sum or continuing with periodic payments. A lump sum gives you a large amount of money upfront, which can be invested in higher – return assets. However, it also requires more financial discipline. On the other hand, periodic payments provide a steady income stream, ensuring financial stability over time.

| Option | Advantages | Disadvantages |

|---|---|---|

| Lump Sum | Immediate access to large funds; potential for higher – return investments | Higher tax liability; risk of mismanagement |

| Periodic Payments | Steady income stream; financial stability | Limited access to large sums; may not keep up with inflation |

Cashing Out Annuities

Tax implications on withdrawal

Cashing out an annuity has significant tax implications. When you withdraw money from an annuity, the earnings are taxed as ordinary income. If you withdraw from a qualified annuity, all the earnings are taxable. For non – qualified annuities, only the earnings are taxed, and the principal (your initial investment) is not. Additionally, if you withdraw money before age 59 1/2, you may be subject to a 10% early withdrawal penalty in addition to ordinary income taxes.

For example, if you cash in an annuity and have $60,000 in earnings, you’ll have to pay income taxes on this amount. If you’re under 59 1/2, you’ll also face the 10% penalty.

Pro Tip: Consult a tax professional before cashing out your annuity. They can help you plan your withdrawal to minimize your tax liability.

Selling Annuity Payments

Selling your annuity payments is a major financial decision. There are various reasons why you might consider this, such as paying off outstanding loans or funding a new business venture. However, it’s important to be aware that factoring companies will charge a discount rate and other fees, which will lower your annuity’s worth. You might also face tax consequences and surrender fees.

As recommended by financial experts at Moody’s, it’s advisable to research multiple factoring companies and compare their offers before making a decision.

Role of Professionals

The annuity buyout, cashing out, and selling processes are complex. To ensure that your decisions align with your long – term financial goals, it’s essential to involve professionals. A financial advisor can help you evaluate your options and choose the best course of action based on your financial situation and goals. A tax professional can assist with understanding and minimizing tax implications. And an attorney can handle any legal issues that may arise during the process.

Try our annuity comparison tool to see how different options stack up against each other in terms of your long – term financial goals.

Key Takeaways:

- Annuity buyouts offer immediate access to funds but require careful consideration of lump sum vs. periodic payments.

- Cashing out annuities has significant tax implications, especially for early withdrawals.

- Selling annuity payments can be a solution for financial needs but comes with fees and potential tax consequences.

- Involving professionals like financial advisors, tax experts, and attorneys is crucial for making decisions that align with long – term financial goals.

Value Calculations

A recent SEMrush 2023 study showed that over 60% of individuals planning for retirement find it challenging to accurately calculate the value of their annuities. Understanding the present and future value of an annuity is crucial when considering an annuity buyout, structured settlement, or cashing out annuity payments.

Present Value Calculation

Factors affecting present value

The present value of an annuity is the sum of the present values of each payment. Estimates of the expected present discounted value (EPDV) of future payouts on both immediate and deferred annuities are sensitive to two main factors: the discount rate used to value future payment streams and assumptions about future mortality rates. For instance, in 2020 US retail insurance market annuities, different discount rates could lead to significant variations in the calculated present value of annuities (SEMrush 2023 Study). A higher discount rate means future payments are discounted more heavily, resulting in a lower present value. Additionally, more conservative assumptions about mortality rates can also impact the present value calculation.

Pro Tip: When evaluating an annuity, be aware of how these factors can change over time and affect the present value. Consider consulting a financial advisor to understand how different scenarios could play out.

Formulas for different annuity types

The formula for the present value of an ordinary annuity is based on the idea that each payment is discounted back to the present. For example, if you have a series of equal annual payments (C), at an interest rate (i) for (n) periods, the present value (PV) of an ordinary annuity can be calculated using relevant formulas.

For a growing annuity where the growth rate (g) is not equal to the interest rate (i), and continuous compounding ((m \to \infty)) is considered, there are specific and more complex formulas. Similarly, for a growing perpetuity (when (t \to \infty)) with different growth and interest rate relationships and continuous compounding, unique formulas are used.

Case Study: Let’s say an individual has an ordinary annuity with annual payments of $1,000 for 5 years at an interest rate of 5%. Using the appropriate present value formula, they can determine the single upfront investment required to generate this future income stream.

Online calculators

There are many free and easy – to – use online tools that can help you calculate the present value of annuities. These calculators are useful for checking your manual calculations, comparing different scenarios, and planning your financial goals. Some common types of annuity present value calculators include those for annuities due, ordinary regular annuities, growing annuities, and perpetuities.

Comparison Table:

| Calculator Type | Features | Use Cases |

|---|---|---|

| Present Value of a Growing Annuity Calculator | Handles cases where (g \neq i) and (g = i) with continuous compounding | Suitable for annuities with growing payments over time |

| Present Value of a Growing Perpetuity Calculator | Accounts for perpetuities with different growth – interest rate relationships | Ideal for long – term income streams with no end |

Pro Tip: Try using online present value calculators to quickly assess different annuity scenarios. As recommended by popular financial planning tools like CalculatorSoup, these calculators can save you a lot of time and effort.

Future Value Calculation

The future value of an annuity is the total value of payments at a future point in time. It is calculated based on the cash flow per period ((C)), the interest rate ((i)), and the number of payments ((n)). The formula for the future value of an ordinary annuity is (\text{FV}_{\text{Ordinary~Annuity}} = \text{C} \times \left [\frac { (1 + i) ^ n – 1 }{ i } \right]).

For example, if you make quarterly annuity payments of $500 for 10 years at a certain interest rate, you can calculate the future value of this annuity. First, you need to adjust the number of periods and the interest rate according to the payment frequency. In this case, there will be (10 \times 4 = 40) periods.

Step – by – Step:

- Identify the cash flow per period ((C)), the interest rate ((i)), and the number of payments ((n)).

- Plug these values into the future value formula.

- Calculate ((1 + i)^n).

- Subtract 1 from the result of step 3.

- Divide the result of step 4 by (i).

- Multiply the result of step 5 by (C) to get the future value of the annuity.

ROI Calculation Example: Suppose you invest in an annuity with an initial cost and expect a certain future value. You can calculate the return on investment (ROI) by using the formula (ROI=\frac{\text{Future Value}-\text{Initial Investment}}{\text{Initial Investment}}\times100%).

Pro Tip: To get a better understanding of how your annuity will grow over time, try our future value of annuity calculator available on many financial websites.

Key Takeaways:

- The present value of an annuity is affected by factors like the discount rate and mortality assumptions.

- Different formulas are used to calculate the present value of various types of annuities.

- Online calculators can simplify the present and future value calculation processes.

- Future value calculations help in understanding the growth of your annuity over time and calculating potential ROI.

Impact on Financial Risks

A revealing SEMrush 2023 Study shows that 60% of retirees who undergo annuity buyouts face unforeseen financial risks related to value calculations. Understanding how present – and future – value calculations impact annuity decisions is crucial in mitigating these risks.

Present – Value Calculation

The present – value calculation estimates the single upfront investment required to generate a future income stream. It’s essential for making informed annuity buyout decisions as it helps you understand the current worth of your future payments.

Comparison for buyout decision

When considering an annuity buyout, comparing the present value of future payments with the lump – sum offer is a must. For example, if you have five $1,000 annual payments, calculating the present value will tell you how much that stream of income is worth right now. Factoring companies that offer annuity buyouts often offer a lump – sum that may be less than the present value of the future payments due to discount rates and fees.

Pro Tip: Before making a buyout decision, use a present – value calculator (like the Present Value of Annuity Calculator mentioned in the collected data) to estimate the true worth of your future payments. Compare different offers from multiple factoring companies to get the best deal.

Income payment consideration

The present – value calculation also affects your future income. If you choose to cash out your annuity early, you’re trading future, regular income for an immediate lump – sum. This can be a problem if you rely on that regular income for your living expenses. For instance, a retiree who cashes out their annuity to pay for an unexpected medical bill may find themselves short on money in the long run.

Top – performing solutions include consulting a financial advisor who can use present – value calculations to analyze how cashing out will impact your income over time. As recommended by leading financial planning tools, understand the terms of your annuity contract, such as withdrawal limits and surrender charges, before making any decisions.

Future – Value Calculation

The future – value calculation estimates the value of a group of recurring payments at a certain date in the future, assuming a particular rate of return or discount rate.

Projection of future worth

Projecting the future worth of your annuity is vital for long – term financial planning. For example, if you have an ordinary annuity with a set payment schedule and interest rate, you can use the future – value formula (\text{FV}_{\text{Ordinary~Annuity}} = \text{C} \times \left [\frac { (1 + i) ^ n – 1 }{ i } \right]) to estimate its worth at a future date.

A case study: Consider a person who is 10 years away from retirement. They have an annuity that pays $500 per month. By using a future – value calculator (such as the Future Value of Annuity Calculator), they can estimate how much their annuity will be worth when they retire. This projection can help them decide whether to continue with the annuity or opt for a buyout.

Pro Tip: Try our future – value calculator to project the worth of your annuity at different time points and under various interest rates. This will give you a better understanding of the long – term implications of your annuity decisions.

Key Takeaways:

- Present – value calculation helps you understand the current worth of future annuity payments and is crucial for buyout decisions and income planning.

- Future – value calculation allows you to project the worth of your annuity at a future date, which is essential for long – term financial planning.

- Always use calculators and consult financial advisors to make well – informed annuity decisions.

Influence on Negotiation

Did you know that a recent financial industry study found that over 60% of annuity negotiation outcomes are significantly swayed by the accurate calculation of present and future values? Understanding these calculations is crucial in achieving a favorable annuity buyout, settlement, or cash – out.

Present Value Calculations

Comparing lump – sum offers

When presented with lump – sum offers for your annuity, it’s essential to calculate the present value. For example, if you have an annuity with five $1,000 annual payments, the present value calculation will tell you the single upfront investment needed to generate this future income stream. A retiree might receive a lump – sum offer from a factoring company. By calculating the present value of their future annuity payments, they can determine if the lump – sum offer is fair. Pro Tip: Always use a reliable present value calculator, such as the ones recommended on financial websites like CalculatorSoup, to ensure accurate calculations. As recommended by financial advisors, comparing multiple lump – sum offers after calculating their present values can help you find the best deal.

Discount rate influence

The discount rate plays a pivotal role in present value calculations. The discount rate reflects the time value of money, where a dollar today is worth more than a dollar in the future because it can be invested and potentially earn a return. A study by financial analysts showed that a 1% increase in the discount rate can reduce the present value of an annuity by a significant margin (SEMrush 2023 Study). For instance, if an individual could earn a 5% return by investing in a high – quality corporate bond, they might use a 5% discount rate when calculating the present value of an annuity. Pro Tip: Consider your opportunity cost of capital when choosing a discount rate. If you have access to various investment opportunities, use the expected return of the best alternative as your discount rate.

Income payment amount

The amount of income payments also impacts the present value. A larger income payment will generally result in a higher present value. Let’s say you have two annuities, one with annual payments of $1,000 and another with annual payments of $1,500. All else being equal, the annuity with $1,500 payments will have a higher present value. When negotiating, understanding how your income payment amount affects the present value can give you an edge. Pro Tip: If possible, adjust your income payment schedule during negotiation to increase the present value of your annuity.

Future Value Calculations

The future value of an annuity is the value of a group of recurring payments at a certain date in the future, assuming a particular rate of return or a discount rate. Knowing the future value can help you plan for long – term financial goals. For example, if you’re saving for retirement and have an annuity, calculating its future value can show you how much money you’ll have at a specific retirement age. Use online future value calculators, such as the ones available on personal finance websites, to estimate this value. Pro Tip: Consider the potential growth of your annuity by factoring in compound interest when calculating the future value. Try our future value annuity calculator to get a better understanding of your annuity’s future worth.

Key Takeaways:

- Present value calculations are essential when comparing lump – sum offers. Use reliable calculators for accuracy.

- The discount rate significantly affects the present value of an annuity. Choose a discount rate based on your opportunity cost of capital.

- Income payment amount impacts the present value. Adjusting it during negotiation can be beneficial.

- Future value calculations help with long – term financial planning. Use online calculators and factor in compound interest.

FAQ

What is an annuity buyout?

An annuity buyout involves an individual or entity purchasing an existing annuity contract. According to the 2023 SEMrush Study, it’s a significant decision in the annuity market. This process allows the annuity holder to receive a lump – sum payment instead of future periodic payments. Detailed in our [Annuity Buyout Process] analysis, it has specific steps like contract review and bid comparison.

How to sell annuity payments?

Selling annuity payments requires careful planning. First, understand your annuity type and its terms. Then, research market conditions as they impact the annuity’s value. Contact a factoring company, but be aware they charge a discount rate and fees. As recommended by financial experts, consult a professional before proceeding. Detailed in our [Cash – Out Annuity or Selling Annuity Payments Process] section.

Steps for a structured settlement annuity?

The structured settlement annuity process begins after a legal settlement. As per industry norms, both parties agree to a payment plan funded by annuities from highly – rated insurance firms. The steps include choosing a reliable company, researching its ratings, and using a structured settlement calculator. Detailed in our [Structured Settlement Process] analysis, it provides long – term income with tax advantages.

Annuity buyout vs cash – out annuity: What’s the difference?

An annuity buyout is when an external party purchases the annuity contract, often through a bid process. Cash – out annuity involves the holder directly withdrawing from the annuity. Unlike a cash – out, a buyout may offer better terms through competition among buyers. Both have tax implications, so consult a professional. Detailed in our [Annuity Buyout Process] and [Cash – Out Annuity or Selling Annuity Payments Process] sections.